Key Takeaways

- Celebrated two-year anniversary in December 2025

- De-risked to 100% T-Bills exposure in advance of the "Tariff Tantrum"

- Can provide downside protection without capping upside participation

- Live performance has tracked in line with research-based expectations

- Complementary portfolio fit to buffer and hedged equity strategies

The MarketVector™-GammaRoad U.S. Equity Strategy Index (Bloomberg: MVGMMA Index, “MVGMMA”) seeks to deliver comparable returns to the S&P 500 Total Return Index over the long term with significantly less drawdown risk.

We expect the strategy to deliver the lion’s share of its value by avoiding the most unfavorable market environments.

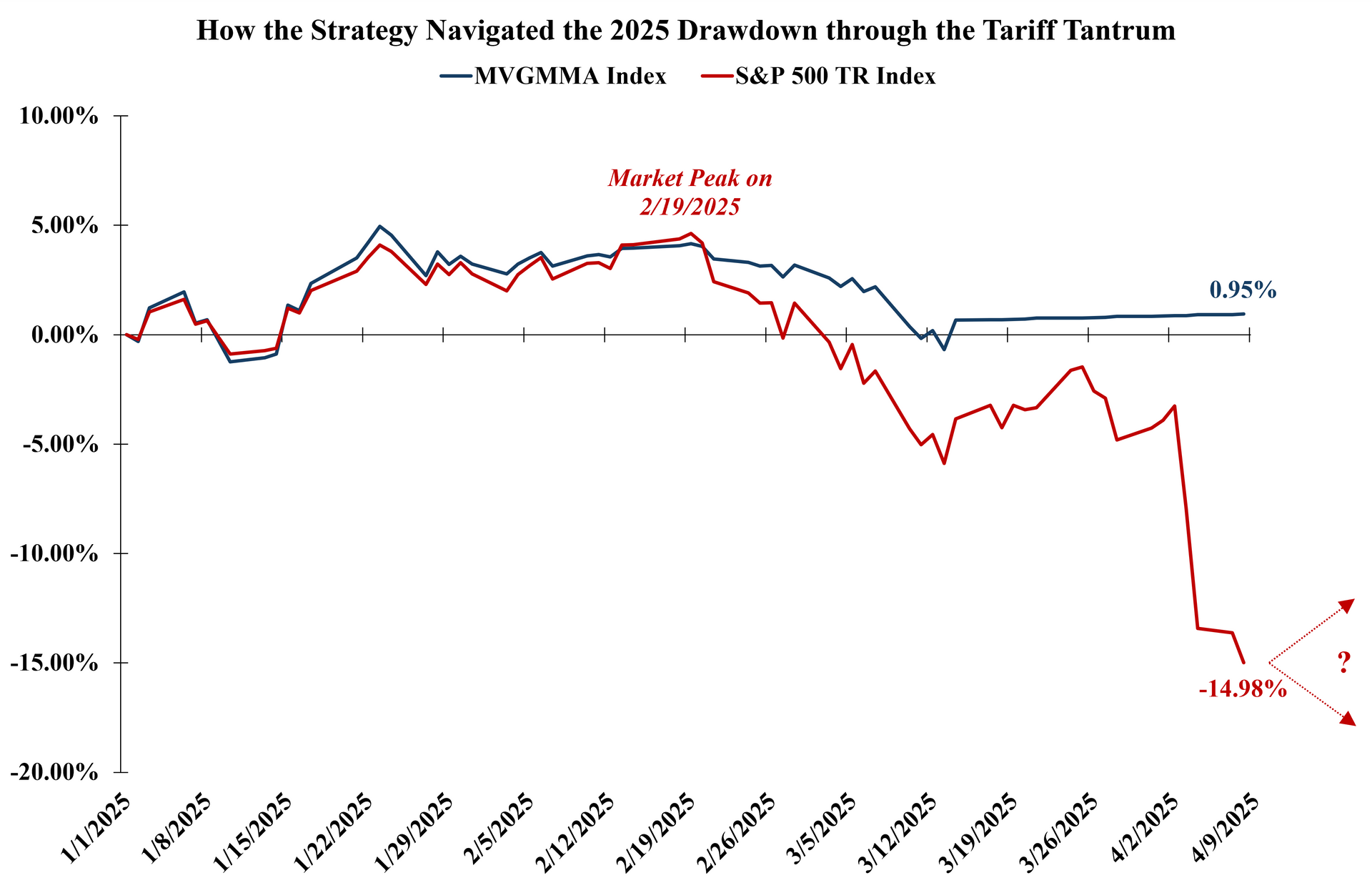

2025’s “Tariff Tantrum” presented the strategy with its first live test of bear market conditions.

While MVGMMA entered 2025 at its maximum equity exposure, each of its

three equity risk measures caused the strategy to de-risk in gradual succession and ultimately hold 100% T-Bills exposure through the market bottom in April. This allowed the strategy to successfully avoid the majority of the drawdown. The following chart illustrates the strategy’s performance path through this period:

Source: GammaRoad Capital Partners, LLC. All performance information reflects the performance of the MarketVector™ -GammaRoad U.S. Equity Strategy Index (Bloomberg: MVGMMA Index) and does not reflect the trading of an actual account. The MVGMMA Index launched on December 22, 2023. Past performance is not indicative of future results. Please see the important disclosures that are integral to understanding the limitations applicable to the quantitative information in the presentation.

We know with hindsight that the market rallied impressively from its low in April. The red arrows and question mark in the chart serve as a reminder that we cannot know at the time whether the market will rally from this point, or whether this is the beginning of the next major bear market.

However, we do know from market history that bear markets can fall much further and can last for several years. An investor with an unlimited time horizon, unlimited capital, and complete immunity to emotionally driven decisions can afford to ignore this reality.

The rest of us must ask ourselves this crucial question: What else do I hold in my portfolio that can potentially protect capital in this manner?

Many investors have turned to buffer and hedged equity strategies as the answer. These approaches typically come with the trade-off of receiving a lower return than the market in exchange for the benefit of mitigating downside risk.

We believe that MVGMMA can provide comparable downside protection and potentially outperform most buffer and hedged equity strategies over the long term. The following table summarizes MVGMMA’s competitive advantages:

| Characteristic | Buffer and Hedged Equity Strategies | MVGMMA |

|---|---|---|

| Downside Protection |

|

|

| Upside Capture |

|

|

| Performance Drivers |

|

|

Based on the comparisons summarized in the table above, we expect MVGMMA to deliver a higher total return than most buffer and hedged equity strategies over the long term while providing comparable downside protection. We have seen evidence of this already in the first two years of MVGMMA’s live track record.

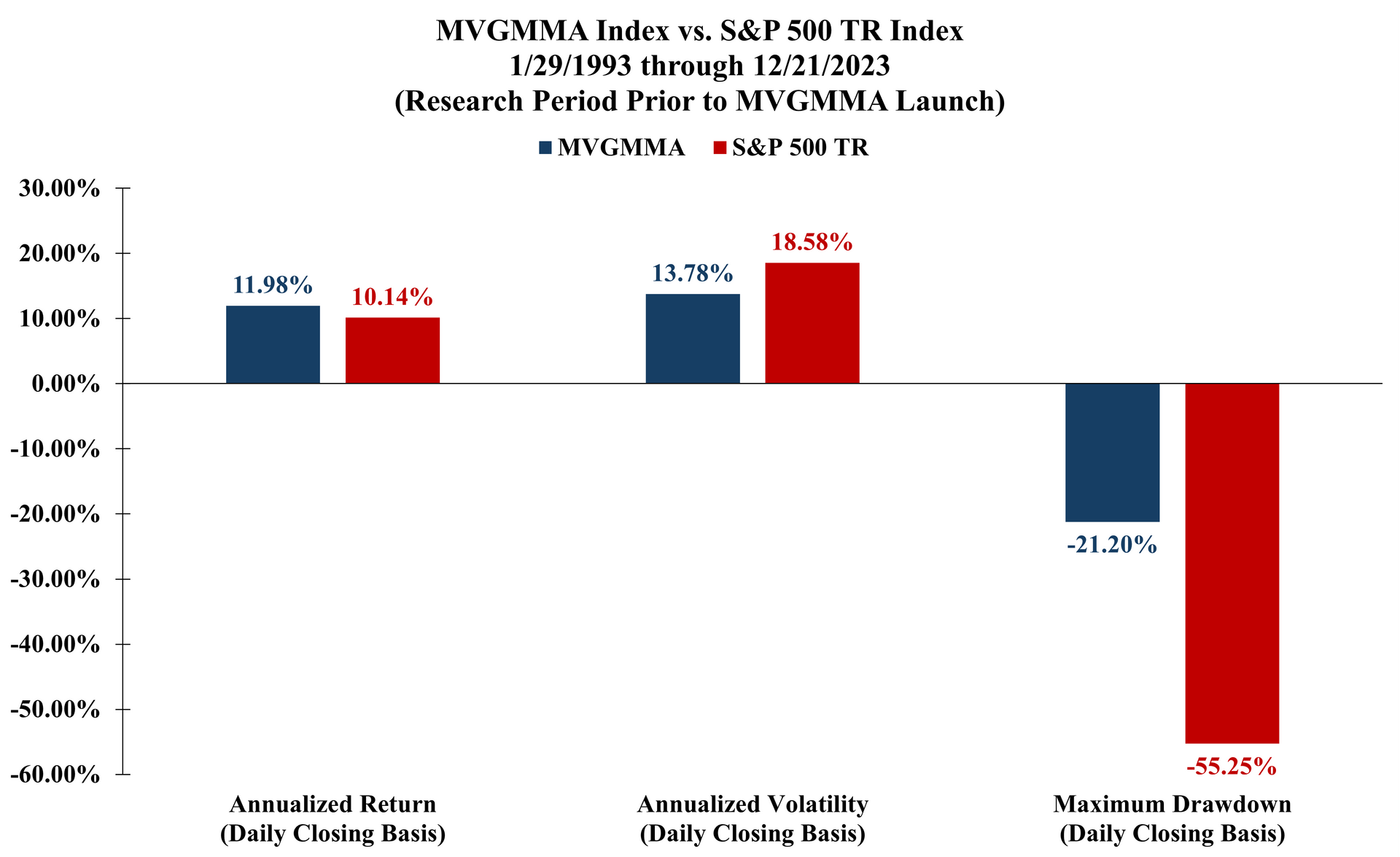

The strategy’s live performance relative to the market has also been in line with our expectations. The following chart shows MVGMMA’s performance during the research period from its base date of January 29, 1993 through December 21, 2023 (the date prior to its launch).

January 29, 1993 was chosen as the base date for the MVGMMA Index so that the full research period would coincide with the inception of the SPDR® S&P 500® ETF Trust (“SPY”), which has the longest history amongst the largest and most liquid ETFs that passively track the S&P 500 Index.

Source: GammaRoad Capital Partners, LLC. All performance information reflects the performance of the MarketVector™ -GammaRoad U.S. Equity Strategy Index (Bloomberg: MVGMMA Index) and does not reflect the trading of an actual account. The MVGMMA Index launched on December 22, 2023. Prior to December 22, 2023, all performance shown herein reflects backtested information based on the application of the MVGMMA Index methodology to the SPY, SSO, and BIL ETFs’ price and dividend data during periods when the MVGMMA Index was not actually published. Past performance is not indicative of future results. Please see the important disclosures at the beginning of this presentation that are integral to understanding the limitations applicable to the quantitative information in the presentation.

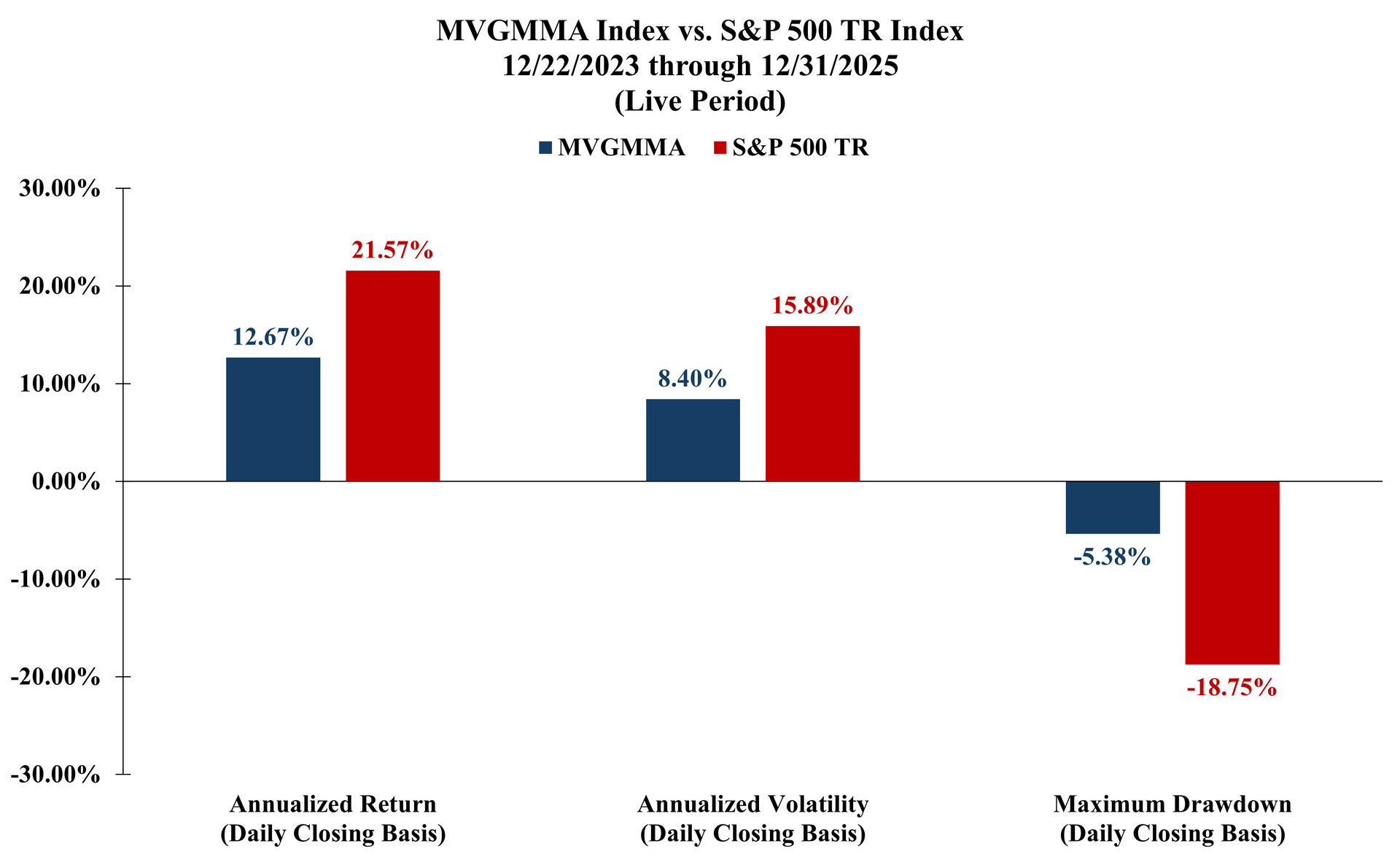

This next chart shows the same metrics since the launch of the MVGMMA Index two years ago:

Source: GammaRoad Capital Partners, LLC. All performance information reflects the performance of the MarketVector™ -GammaRoad U.S. Equity Strategy Index (Bloomberg: MVGMMA Index) and does not reflect the trading of an actual account. The MVGMMA Index launched on December 22, 2023. Past performance is not indicative of future results. Please see the important disclosures that are integral to understanding the limitations applicable to the quantitative information in the presentation.

Here are our key observations from comparing MVGMMA’s live track record to our expectations based on the research period:

- MVGMMA’s annualized volatility and maximum drawdown since its launch have both been significantly lower than those of the S&P 500 Total Return Index. These results are in line with our expectations based on the multi-decade research period.

- The market’s annualized return has exceeded MVGMMA’s annualized return since its launch.

MVGMMA seeks to deliver comparable returns to the S&P 500 Total Return Index over the long term with significantly less drawdown risk. We define “the long term” as one complete market cycle or multiple market cycles.

As stated above, we expect MVGMMA to deliver the lion’s share of its value by avoiding the most unfavorable market environments.

Given that the live period does not represent a full market cycle, we do not yet know how much of the market’s recent returns may be given back during the eventual bear market that completes the current cycle.

We view this shorter-term performance difference as a worthy trade-off for potentially achieving the strategy’s long-term objective over the coming years.

While most buffer and hedged equity strategies share this same trade-off, we believe MVGMMA’s design provides multiple advantages (as shown in the table earlier) that can allow it to outperform most of these strategies. For this reason we view MVGMMA as an excellent complement within a portfolio’s equity allocation.

Why This Matters

As we enter the third year of MVGMMA’s live track record, the strategy’s performance has reinforced our confidence and belief that:

- This strategy can grow your clients’ wealth better over the long term.

- This approach can make you look smarter to your clients over the long term.

- During the next bear market, this strategy can protect your clients’ capital in a way that can cement your clients’ loyalty and confidence in you.

For a refresher on the strategy’s architecture and underlying process, please watch our video here.

Important Disclosures

THIS PRESENTATION AND THE INFORMATION CONTAINED HEREIN WAS PREPARED BY GAMMAROAD CAPITAL PARTNERS, LLC (“GAMMAROAD”) AND IS SUBJECT TO AND QUALIFIED BY THE IMPORTANT DISCLOSURES BELOW.

Confidential

This presentation is directed solely to existing and potential users of the MarketVector™-GammaRoad U.S. Equity Strategy Index (Bloomberg: MVGMMA Index,

“MVGMMA Index”) and is furnished on a confidential basis only for the use of the recipient and only for discussion purposes. This presentation and its contents are proprietary information of GammaRoad and may not be reproduced or otherwise disseminated in whole or in part without GammaRoad’s prior written consent.

Not Advice or Recommendation

This presentation is neither advice nor a recommendation to enter into any transaction. This presentation is for information, illustration and discussion purposes only and is not intended as an offer to buy or sell, nor a solicitation of an offer to buy or sell, any security, commodity or other financial instrument. Nothing contained in this presentation is intended to represent the rendering of accounting, tax, legal, regulatory or investment advice by GammaRoad. While investors should understand and consider the risks associated with making an investment decision, this presentation should not be relied upon for that purpose and should not be a basis of any investment decision or retention of the MVGMMA Index. This presentation and the MVGMMA Index do not take into account the particular investment objectives, financial circumstances, restrictions, particular needs or financial, accounting, regulatory, legal or tax situation of any particular person, investor or type of investor. Neither GammaRoad nor its principals, officers, employees or associated funds or entities (all of the foregoing collectively, “Related Persons”) hereby makes any representation to any person or entity as to the suitability of the MVGMMA Index or any investments nor provide advice or recommendations regarding an investor’s decision to allocate funds based on the use of the MVGMMA Index or to maintain or sell investments based on the MVGMMA Index.

An investment decision by you to employ the MVGMMA Index in any capacity should be based on your independent judgment and customary and thorough due diligence procedures, including consultation with your own professional tax, legal and investment advisors. You should also inform yourself as to: (1) the legal requirements within your jurisdictions for the purchase, holding or disposal of investments; and (2) any income and other taxes which may apply to the purchase, holding and disposal of investments. Furthermore, you should keep in mind that any subsequent change in facts or circumstances could materially affect the accounting, tax, legal or regulatory treatment consequences of the MVGMMA Index and investments. Before you make any investment decisions based on the MVGMMA Index, you should determine whether the investment is suitable for you in light of your circumstances, investment objectives, financial situation and risk tolerance.

GammaRoad is not an Advisor or a Fiduciary

GammaRoad is not and does not purport to be an advisor as to legal, taxation, accounting, financial or regulatory matters in any jurisdiction. GammaRoad is not registered with any federal or state regulator and no fiduciary relationship under federal and/or state securities laws, the Commodity Exchange Act and/or ERISA is created by investing based on the MVGMMA Index, or through any communication with GammaRoad.

Limitation on Liability

No liability whatsoever is accepted for any loss (whether direct, indirect, or consequential) that may arise from any use of the information contained in or derived from this presentation or by use of the MVGMMA Index. In addition, GammaRoad, disclaims any and all liability as to the completeness or accuracy of the information contained herein and for any omissions of material facts. However, nothing herein shall in any way constitute a waiver or limitation of any rights available under applicable federal or state laws.

MVGMMA Index is Subject to Change

Please reference the MVGMMA Index Guide at www.marketvector.com/rulebooks/download/MVGMMA_Index_Guide.pdf for information regarding the development of the MVGMMA Index, its methodology and its risk management techniques.

Any changes to the Index Guide will be reviewed and approved by MarketVector Indexes (“MarketVector”) and MarketVector’s Legal and Compliance Department. MarketVector’s Legal and Compliance Department may also request a conclusive description and further information on any change and may consult MarketVector’s operations department on such changes. The key elements to be analyzed in this phase of the change process are robustness, transparency, reliability and integrity. The result of the review will be communicated to MarketVector’s operations department. The email will be archived by MarketVector’s operations department.

Changes that might immediately change the composition of the MVGMMA Index or must be considered material for any other reason also need to be approved by MarketVector’s Independent Oversight Function (“IOF”) prior to their publication and implementation.

In case of material changes an advance notice will be published and provided to users by MarketVector. MarketVector will generally disseminate a notification related to an Index Guide change 30 days prior to the change. A shorter period of time may be applied at MarketVector’s discretion if the relevant index has not been licensed for a financial product to a third party. The notice will describe a clear time frame that gives the opportunity to analyze and comment upon the impact of such proposed material change. Any material comments received in relation to the Index Guide change and MarketVector’s response to those comments will be made publicly accessible after any consultation, except where confidentiality has been requested by the originator of the comments.

Investment Performance

All performance information reflects the performance of the MarketVector™-GammaRoad U.S. Equity Strategy Index and does not reflect the trading of an actual account. The MVGMMA Index launched on December 22, 2023. Prior to December 22, 2023, all performance shown herein reflects backtested information based on the application of the MVGMMA Index methodology to the SPDR® S&P 500® ETF Trust (“SPY”) and the ProShares Ultra S&P500® (“SSO”) price and dividend data for the MVGMMA Index’s equity component during periods when the MVGMMA Index was not actually published. Prior to the inception of the SSO, the performance exhibits use twice the daily return of the SPY minus the daily equivalent of the SSO’s total expense ratio. For the non-equity component of the MVGMMA Index, the performance exhibits use the daily return and dividends for the SPDR® Bloomberg 1-3 Month T-Bill ETF (“BIL”). Prior to the inception of the BIL, the performance exhibits use a cash return that is the daily equivalent of the market yield on U.S. Treasury Securities at 3-Month Constant Maturity minus the daily equivalent of the BIL’s total expense ratio. The slides that show target equity weight changes apply the MVGMMA Index methodology to the S&P 500 Index price data during the periods shown. Both the S&P 500 TR and the S&P 500 Index (collectively the “S&P 500 Indices”) are indices comprised of the same 500 stocks chosen from all major industries based on market size, liquidity and industry grouping, among other factors. The difference between the S&P 500 TR and the S&P 500 Index is that the S&P 500 TR reflects the reinvestment of dividends while the S&P 500 Index does not. Investments cannot be made directly in broad-based securities indices. Therefore, the application of the MVGMMA Index methodology to the S&P 500 Indices is for illustration purposes only to demonstrate the efficacy of the MVGMMA Index methodology applied to these indices. January 29, 1993 was chosen as the base date for the MVGMMA Index so that the full research period would coincide with the inception of the SPDR® S&P 500® ETF Trust (“SPY”), which has the longest history amongst the largest and most liquid ETFs that passively track the S&P 500 Index. Additional information about the S&P 500 Indices and the U.S. Treasury Securities at 3-Month Constant Maturity is available from GammaRoad upon request.

The investment performance shown includes the reinvestment of dividends, interest and capital gains according to the MVGMMA Index and there was no withdrawal of cash during the performance period. In addition, you may pay brokerage commissions, exchange fees, and clearing fees to execute the MVGMMA Index methodology, none of which are subtracted in calculating the back-tested performance shown. Differences in the methodology used to calculate performance may also lead to different performance results than those shown. Annualized total return is computed on a compounded monthly basis. Volatility (standard deviation) and maximum drawdown percentage are computed on a daily basis. Beta and skew are computed on a monthly basis.

Back-tested performance is a type of hypothetical performance that cannot completely account for the impact of financial risk in actual management of a portfolio. In fact, there can be sharp differences between hypothetical performance results and the actual results subsequently achieved by any particular investment strategy due to many factors, some of which are described below. For example, the ability to withstand losses and adhere to the MVGMMA Index methodology in spite of trading losses is unknown and could have adversely affected actual results. Furthermore, back-tested performance results are prepared with the benefit of hindsight. This means that the MVGMMA Index has been formed in the present based in part on application of the MVGMMA Index methodology to the SPY, SSO, and BIL ETFs during the back-tested periods. The MVGMMA Index may have been constructed differently if GammaRoad did not have the benefit of its current hindsight and the MVGMMA Index may have performed significantly worse than the performance reflected herein. Furthermore, if the MVGMMA Index changes, the back-tested performance shown is not indicative of how the MVGMMA Index will perform if these changes occur. In addition, as noted above the back-tested performance shown does not subtract any brokerage commissions, exchange fees, and clearing fees. For the foregoing reasons and for numerous other reasons related to the markets, no representation is made that any investor using the MVGMMA Index will or is likely to achieve profits or losses similar to those shown.

Performance may vary substantially from year to year or even from month to month. Differences in the timing of transactions and market conditions prevailing at the time of investment may lead to different results. The value of investments can go down as well as up. Past performance is not indicative of future results and GammaRoad makes no representation that any user of the MVGMMA Index will or is likely to achieve profits or losses similar to those shown herein.

Benchmark Comparison

The performance shown is compared to the S&P 500 TR. The comparisons to the S&P 500 TR are included merely to show the general performance in the market in the periods indicated and is not intended to imply that the MVGMMA Index is similar to the S&P 500 TR in either composition or element of risk. Investments cannot be made directly in a broad-based securities index.

Risk of Loss and Other Risks

Investing in securities entails certain risks, including the possible loss of the entire principal amount invested. Volatility and returns depend on a variety of factors including overall market conditions, and unpredictable economic and political events.

All projections, valuations, and statistical analyses are provided to assist the recipient in the evaluation of the matters described herein. Such projections, valuations and analyses may be based on subjective assessments and assumptions and may use one among many alternative methodologies that produce different results; accordingly, such projections, valuations and statistical analyses should not be viewed as facts and should not be relied upon as an accurate prediction of future events.

Investments pursuant to the MVGMMA Index may be exposed to risks relating to non-U.S. markets, including, without limitation, risks relating to currency exchange, tax, lack of liquidity, market manipulation, political instability and higher transaction costs.

No representation is made that the MVGMMA Index's investment processes, investment objectives, goals or risk management techniques will or are likely to be achieved or successful, or that the MVGMMA Index methodology and/or any investment will make any profit or will not sustain losses. The MVGMMA Index may not be suitable for everyone.

Conflicts of Interest

GammaRoad’s Related Persons may invest personal assets pursuant to the MVGMMA Index methodology. To address potential conflicts of interest with the investing of users of the MVGMMA Index, GammaRoad has instituted an internal Personal Trading Policy with which all Related Persons are required to comply. With respect to each GammaRoad strategy, GammaRoad’s Personal Trading Policy seeks to allow users to have the opportunity to trade before and at better prices than Related Persons. A copy of GammaRoad’s Personal Trading Policy is available upon request.

Limitations on Information Contained Herein

This presentation is based on information including, but not limited to third-party benchmark information, that has been obtained from sources that GammaRoad believes to be reliable; however, such information has not been independently verified. GammaRoad (i) makes no representation as to, and accepts no responsibility or liability for, the accuracy, truthfulness or completeness of the information; (ii) and does not represent it as accurate, true or complete; (iii) makes no warranty, express or implied regarding it; and (iv) shall not be liable for any losses, damages, costs or expenses relating to its adequacy, accuracy, truth, completeness or use unless the waiver of such liability constitutes the waiver of any rights you may have under applicable federal or state laws.

The information in this presentation is current as of the date indicated and is subject to change or amendment. The delivery of this presentation at any time does not imply that the information contained herein is correct at any time subsequent to such date. GammaRoad undertakes no responsibility or obligation to revise or update this presentation and/or the opinions, statements, assumptions, analyses, assessments, projections, forward looking statements, similar statements and other views expressed in this presentation (collectively, the “Statements”). All Statements constitute only subjective views of GammaRoad, should not be relied on, and are subject to change without notice due to many factors, including fluctuating market conditions, and economic factors.