U.S. Equity Strategy Updates

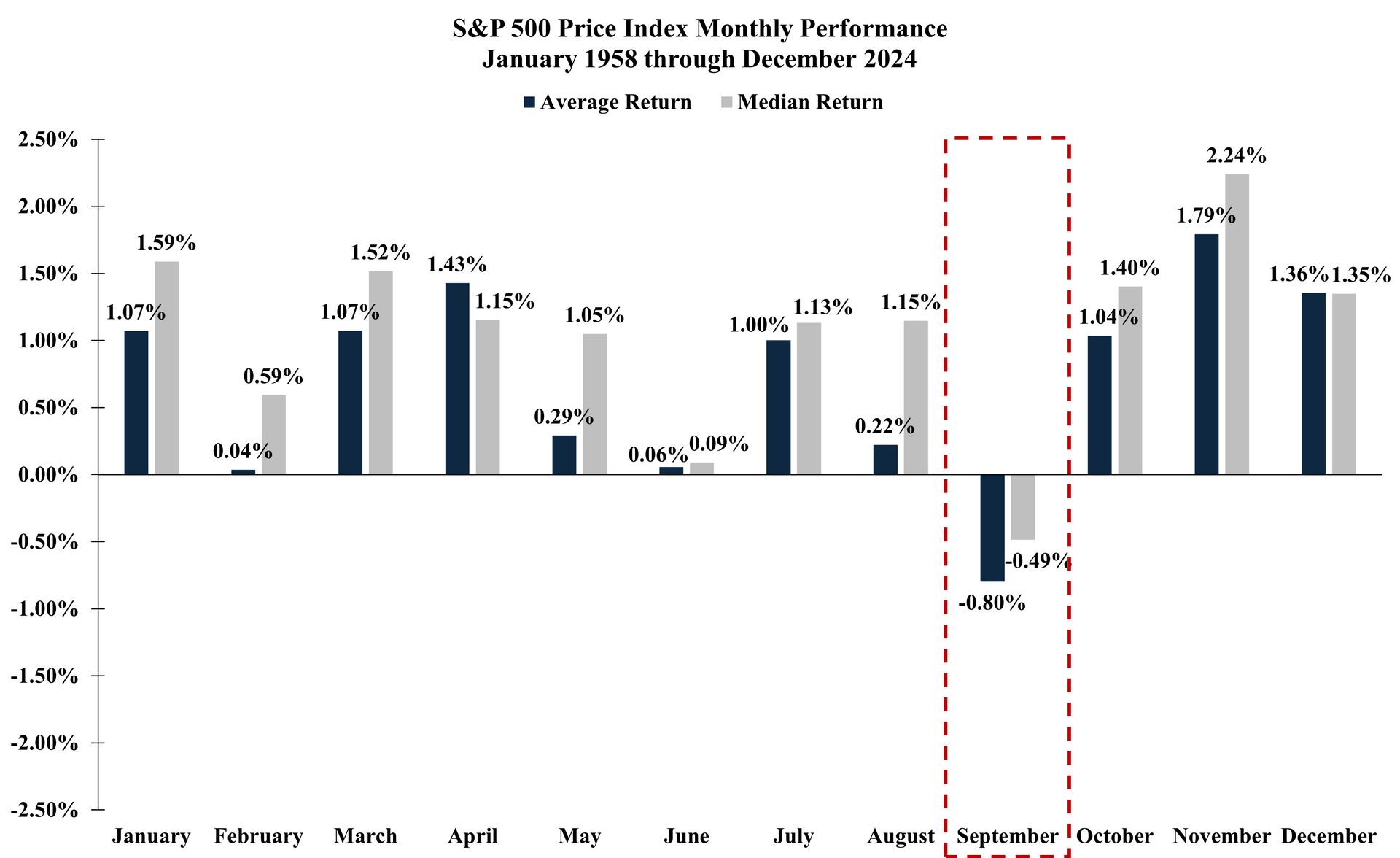

Many markets across asset classes can demonstrate seasonality to their historical performance, and the U.S. equity market is no exception. While the summer months typically deliver a favorable return profile, September has certainly earned its reputation as the least favorable month of the year for U.S. equities...

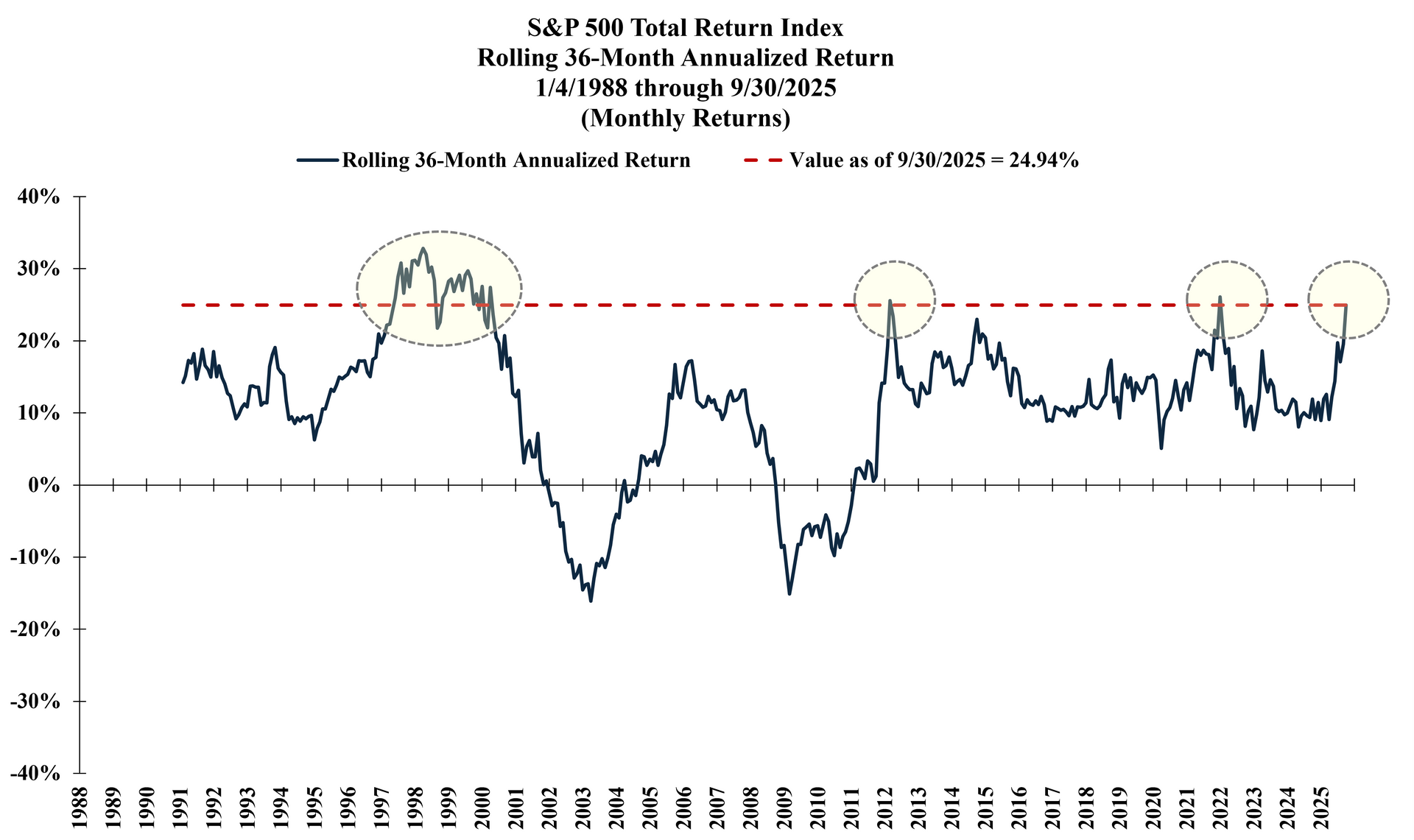

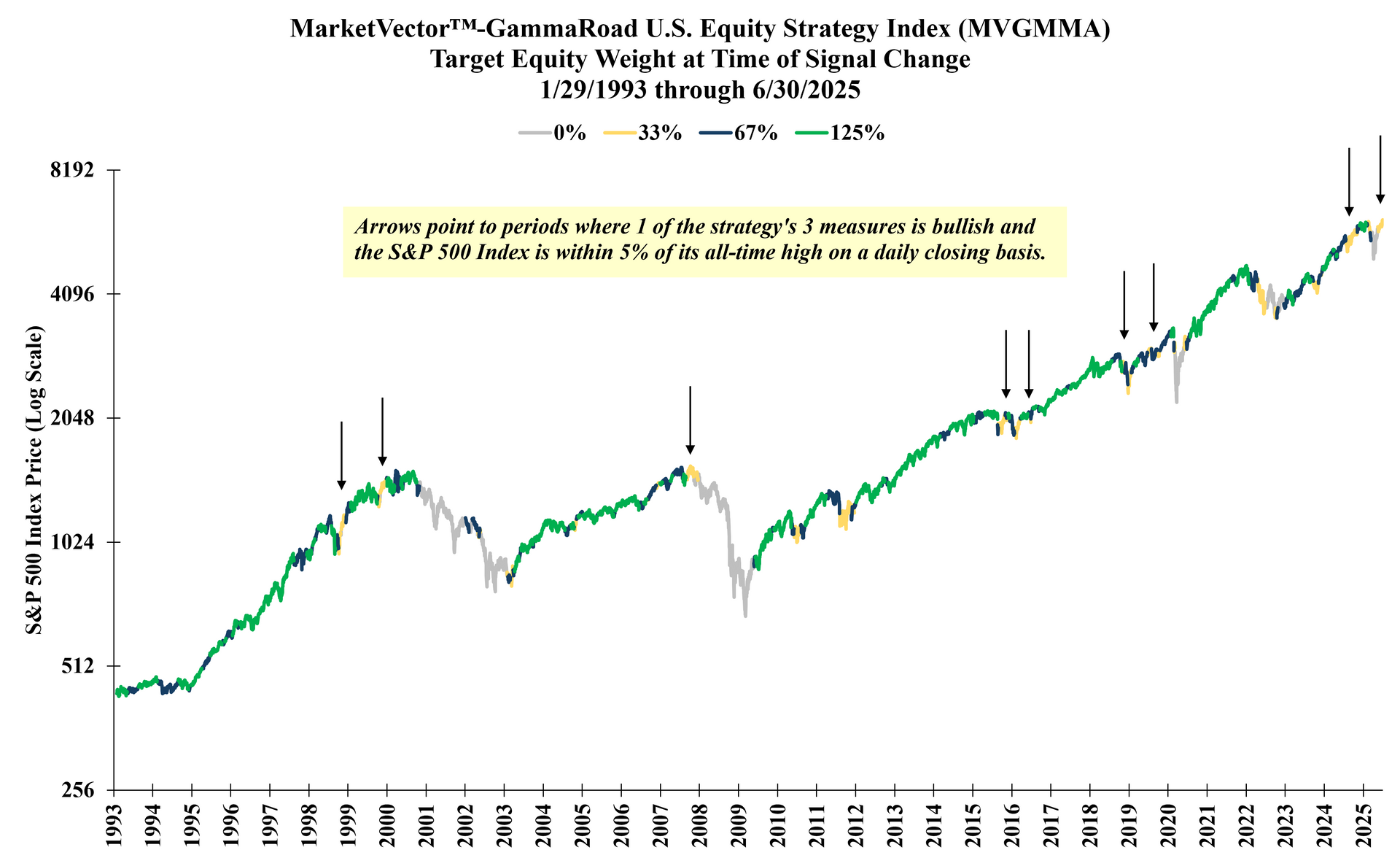

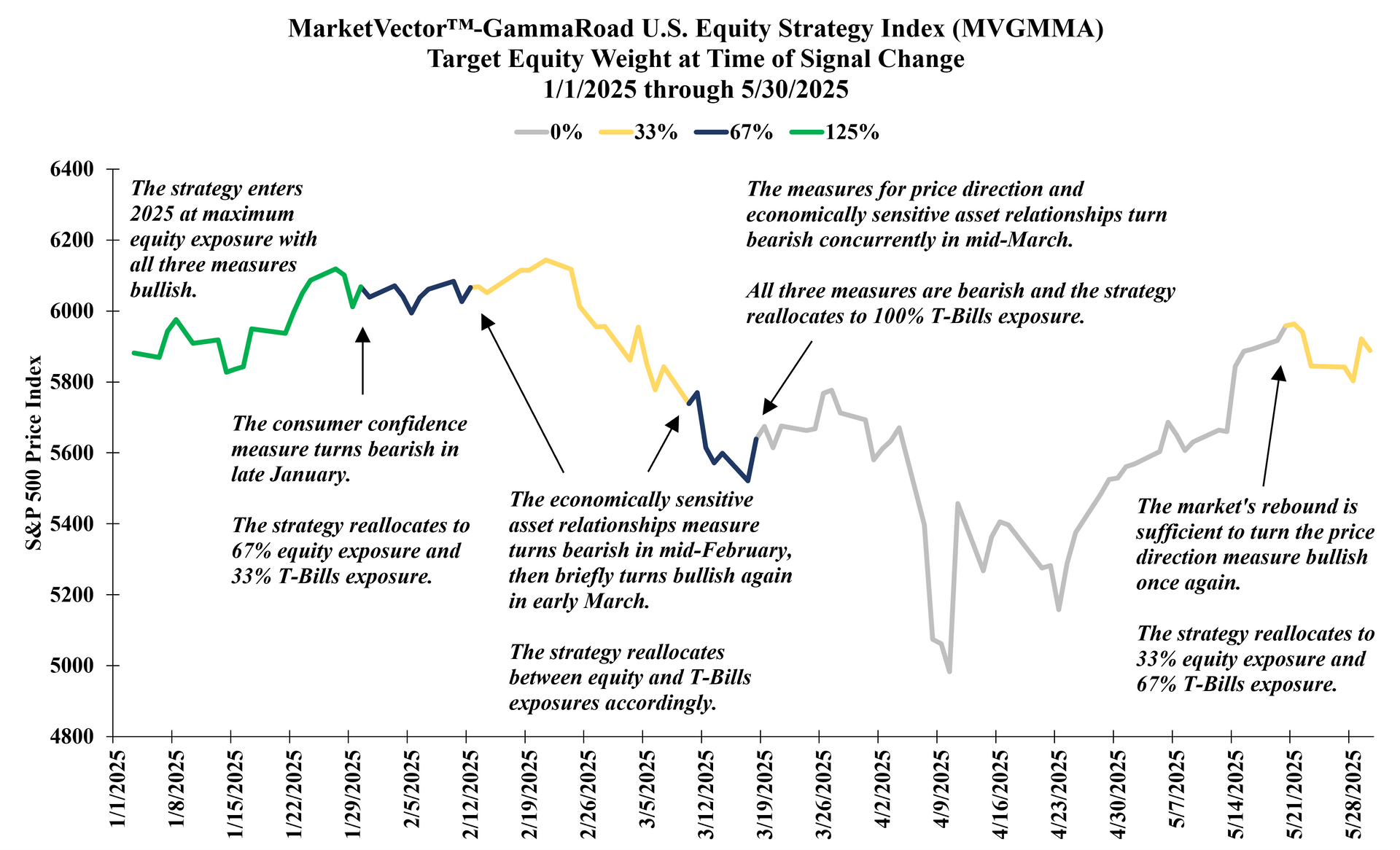

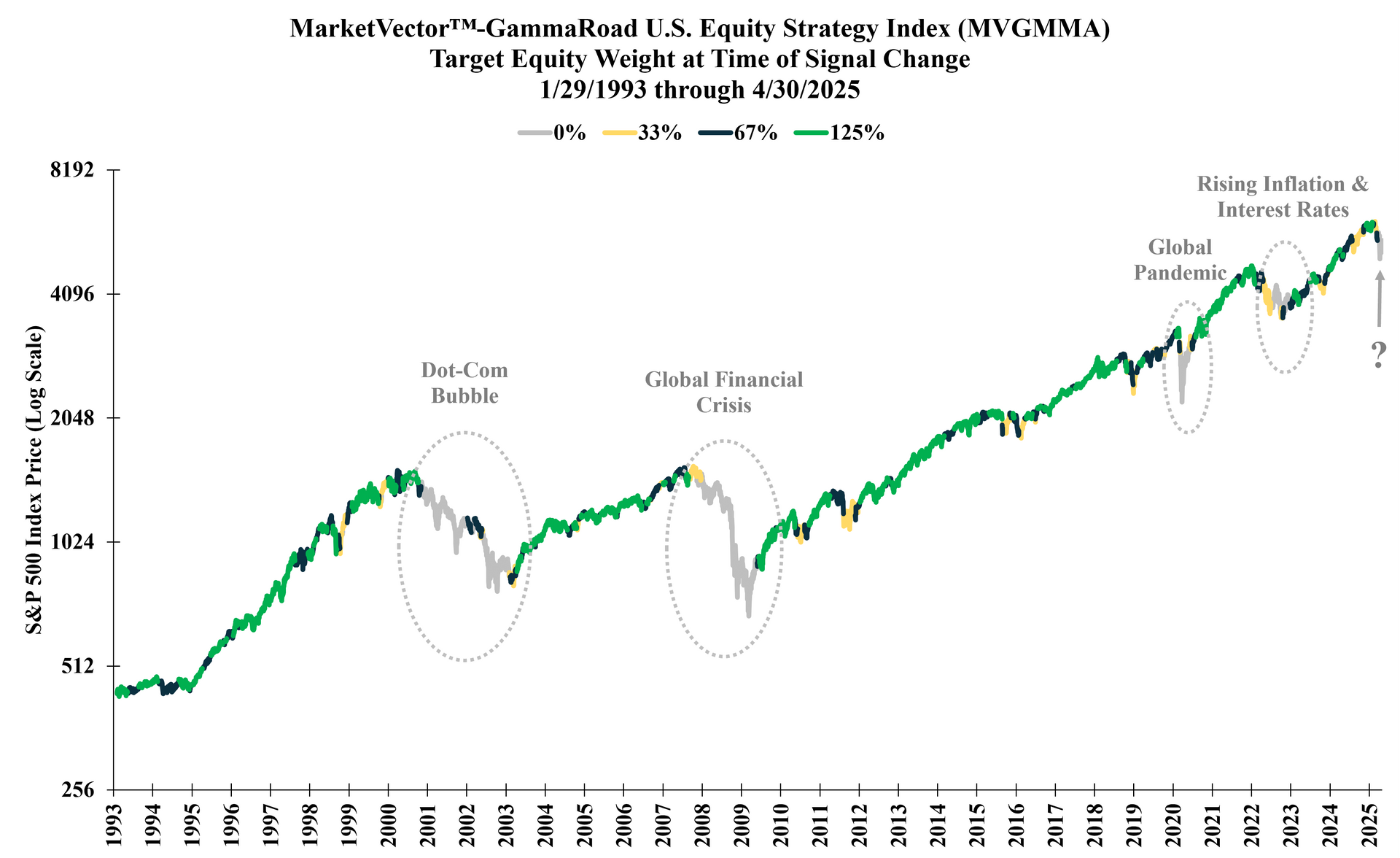

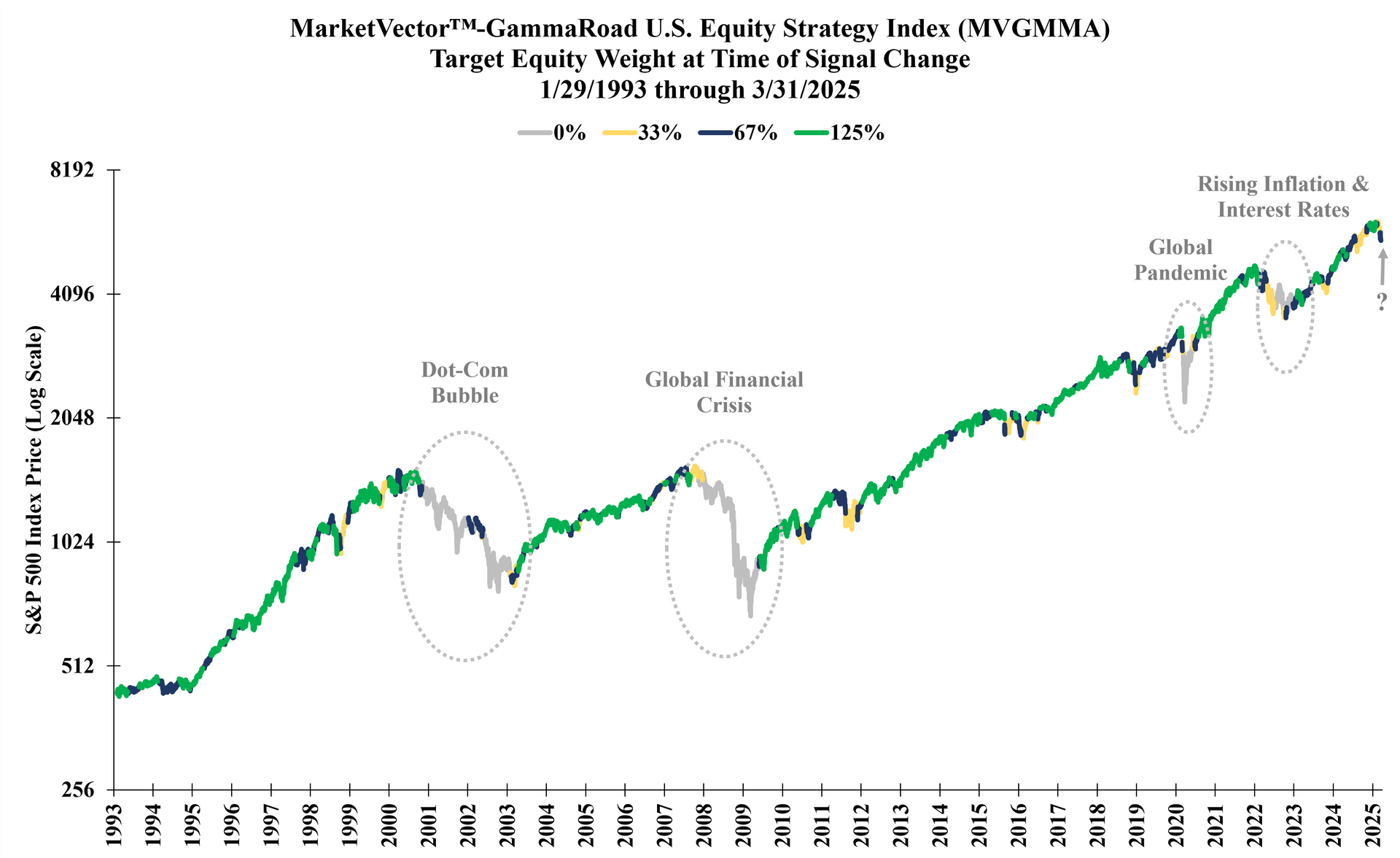

What a difference one month can make. The market’s impressive rally from the April lows continued through May, as the S&P 500 Total Return Index returned +6.29% for the month. This brought the market’s year-to-date return at +1.06% back into positive territory for the first time since January. The MarketVector™-GammaRoad U.S. Equity Strategy Index (Bloomberg: MVGMMA Index) held 100% T-Bills exposure through mid-May, until the market’s rally was sufficient to turn the strategy’s price trend measure bullish once again. As a result, the strategy reallocated to...

The S&P 500 Total Return Index fell modestly in April, although it likely did not feel anything like “modest” for equity investors. The market swiftly plummeted -11.19% through the first 6 market days of the month, before staging an impressive rally to finish down -0.68% for April and down -4.92% year-to-date. The MarketVector™-GammaRoad U.S. Equity Strategy Index (Bloomberg: MVGMMA Index) maintained its 100% T-Bills exposure throughout April and returned +0.34% for the month and +1.18% year-to-date. The primary question on many investors’ minds might be...

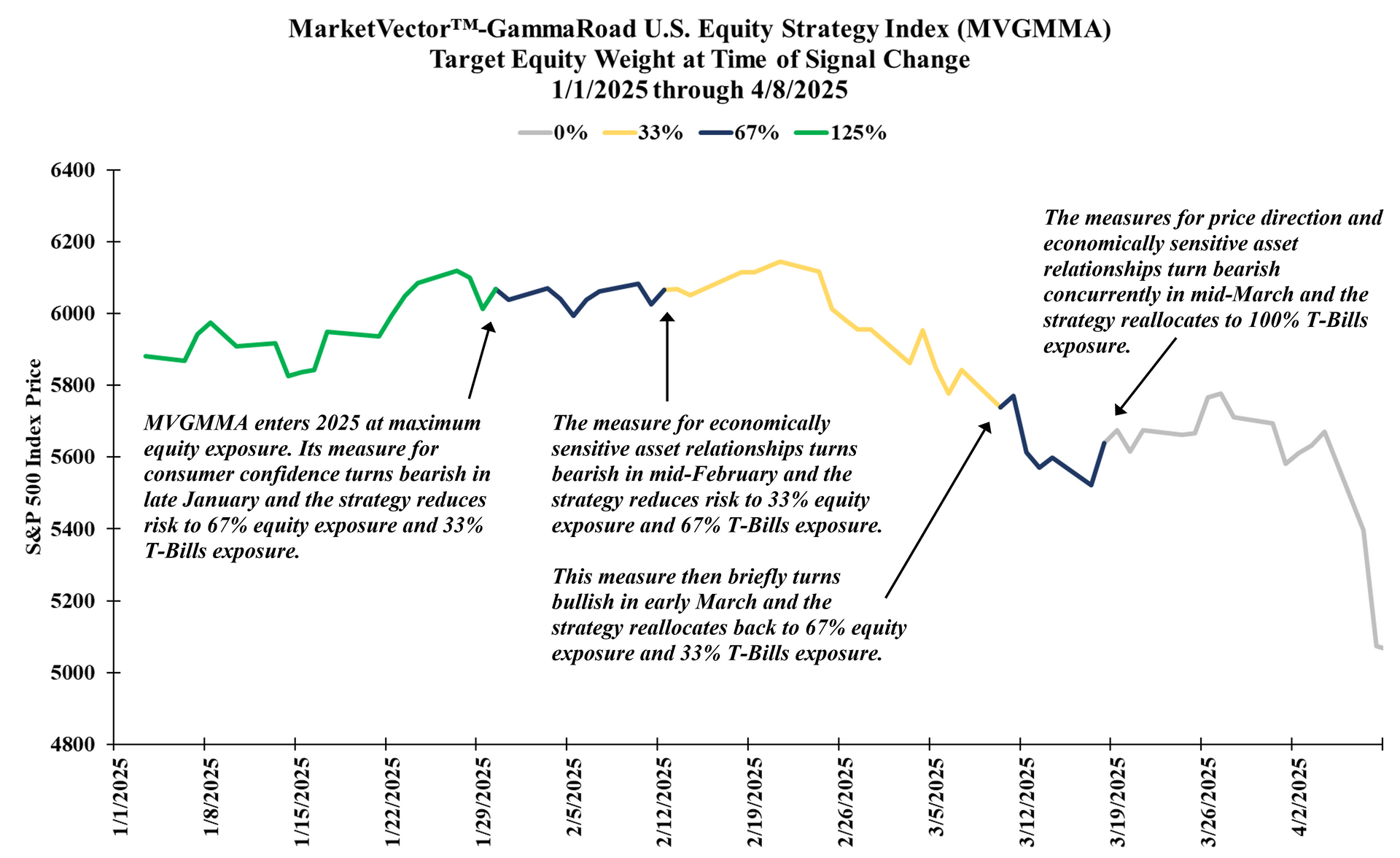

This has been quite a start to 2025, and this year is already providing an excellent opportunity for The MarketVector™-GammaRoad U.S. Equity Strategy Index (Bloomberg: MVGMMA Index) to demonstrate its value and potential to navigate significant changes in market conditions. The S&P 500 Total Return Index experienced its second consecutive down month in March and fell by -5.63%. The MarketVector™-GammaRoad U.S. Equity Strategy Index benefitted from entering March at roughly 33% equity exposure and 67% T-Bills exposure. During the month...